Learn about Security Deposit Experiences in Accordance to CHBO Property Owners

Admin

Admin

Published Date: 2019-05-08

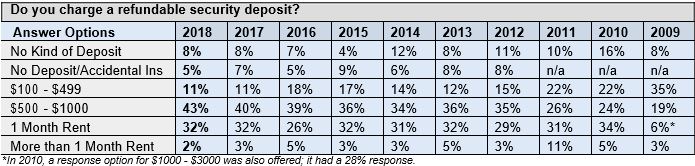

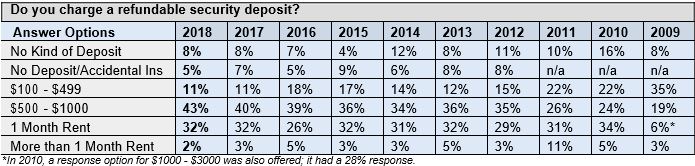

CHBO always recommend owners opt for the ARDP. This option is a win/win for the owner and the renter. Renters don’t have to tie up large amounts of money and owners don’t have to nickel and dime their tenants or worse come out of pocket for accidental damages during the lease term. Owners just submit a claim with repair/replace receipts and through the ARDP the owner is reimbursed, the best part is they don’t have to involve the tenant.

Deposits can be deal killers as most property owners know. What happens when there is damage? If you charge the renter a fee to their security deposit what are the chances you get a good review? More importantly is the liability that comes with taking funds from a security deposit. Each state varies but if an owner changes for damages that the tenant did not do, the owner can be held liable for somewhere up to 3x the amount they charged the tenant. Some of our property owners waive the security deposit in Lieu of Accidental Rental Damage Protection (ARDP) which covers your property up to $5000 in accidental rental damage.

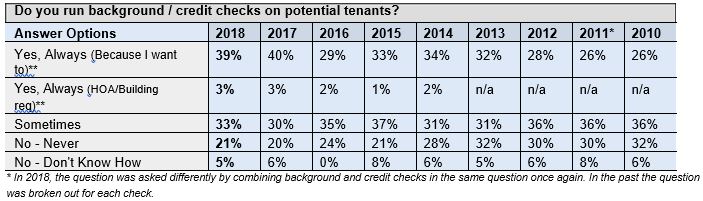

Credit & Background Checks

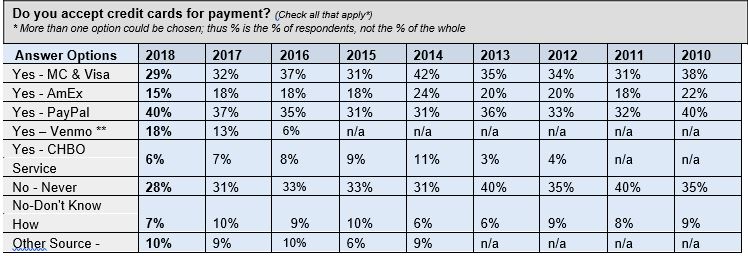

Credit Cards

I?n today’s digital world, the ability and willingness of property owners to accept credit cards is important. Credit cardservices like Paypal, Venmo, Square and Zelle are on the rise as these platforms become more known and trusted.

In 2018, PayPal lead the way as the ?most popular credit solution?.

In the ? “other” category in 2018?, respondents listed: ACH – Direct Banking, Square, Wire Transfer and Zelle.

The trend to note here is that the option of “No-never” is an all-time low at 28%. Of course, we expect this trend to continue to decline but will keep watch.