CHBO in the News

Published Date: 2025-07-01

CHBO Promotes Jessica Lewis to Director of Client Services

We’re excited to share some big news from the CHBO team!

Jessica Lewis, a long-standing and valued member of our organization,...

read more

CHBO in the News

CHBO in the News

Published Date: 2025-06-26

When it comes to corporate housing, first impressions matter. In today’s competitive market, renters expect more than just a clean place to stay; they want comfort, style, and functionality. As...

read more

CHBO in the News

CHBO in the News

Published Date: 2025-06-20

We’re excited to share some fantastic news — the CHBO Blog has been recognized as one of the Top 35 Corporate Housing Blogs on the Web by Feedspot, a leading platform for discovering the...

read more

CHBO in the News

CHBO in the News

Published Date: 2025-01-09

California wildfires have caused immense devastation, leaving thousands of individuals and families displaced and searching for safe, reliable housing in the Pacific Palisades/Malibu, Ca area....

read more

CHBO in the News

CHBO in the News

Published Date: 2019-09-09

As a corporate housing property manager, there are certain requirements. You need to spend money to manage the property in order to bring in renters and offer them a space they want to come back to...

read more

CHBO in the News

CHBO in the News

Published Date: 2019-04-10

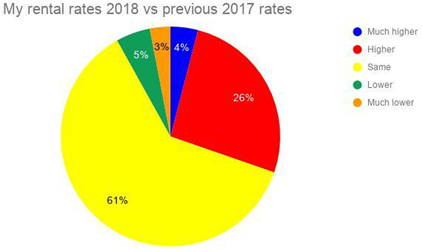

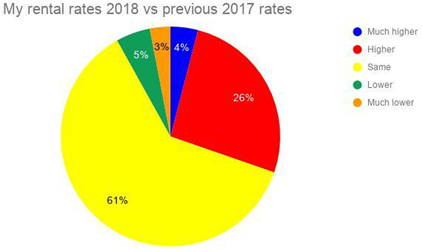

Variance: Changes in Rental

Rates

We asked respondents to evaluate their current rental rates compared to the previous year for the exact same rental property.

Annual...

read more

CHBO in the News

CHBO in the News

Published Date: 2019-03-20

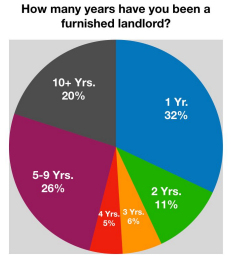

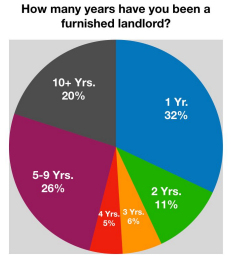

DENVER (PRWEB) MARCH 20, 2019

Corporate Housing By Owner (CHBO), has recently completed its 10th annual Corporate Housing Real Estate survey. For the first time, since the survey began, they...

read more

CHBO in the News

CHBO in the News

Published Date: 2018-11-13

If you are about to invest in corporate rentals and executive rentals, or you already own them and wish to be in full agreement with federal laws, you need to be aware of the Fair Housing Act. It is...

read more

CHBO in the News

CHBO in the News

Published Date: 2018-07-12

The results are in, so let’s dig deeper. Each week CHBO will analyze data from the annual corporate housing report and open a discussion. Please provide feedback with your experiences in 2017. This...

read more