Homeowners Insurance or Landlord Insurance: Which Should I Obtain?

Admin

Admin

Published Date: 2023-06-07

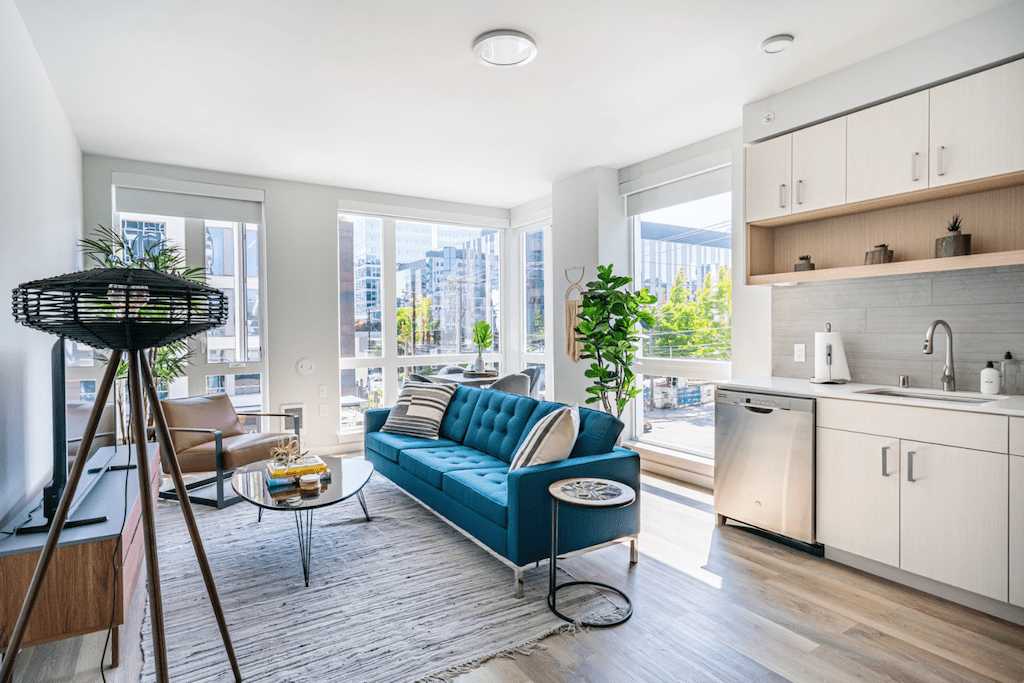

When you work with CHBO to place your rentals, the process is a cinch. All you need to do is create rental listings, upload some photos of your properties, and then publish them for millions of people to see. Our dashboard makes it easy to communicate with tenants and keep things organized, no matter how many rentals you offer.

As someone offering short- and mid-term rentals, you might have questions about other aspects of the process. For instance, maybe you question whether you should purchase landlord insurance or homeowners insurance. This blog will go into detail so you do the right thing for your corporate home rentals.

Landlord Insurance Is Designed for Corporate Rentals

When someone purchases homeowners insurance, it’s to protect the investments of the person who lives in the home. The coverage tends to be quite extensive and will cover anything that isn’t explicitly excluded. Covered events often include things like damage from rain, wind, lightning, snow, fires, vandalism and break-ins, water damage, and accidents.

On the other hand, landlord insurance can cover those who do not permanently live in a home. While you can live in corporate housing as well, that requires a personal policy apart from the one you use for your tenants. This insurance is tailored to meet your needs and covers the parts of the property that you own.

Most of the exclusions and covered events in landlord insurance are similar to that of homeowners insurance. However, there is also extra coverage for accidental damage caused by a tenant who stays in the property.

The Main Difference Between the Two Types of Insurance

One of the largest differences between homeowners' and landlord's insurance comes down to what belongings are covered. Homeowners’ insurance covers the structure of the property as well as the items kept inside the home. This typically is not the case for landlord insurance, as personal items of the owner are often not left in the home.

Coverage will be limited to the actual home, along with things like flooring, carpeting, cabinetry, and similar items. Tenants will be responsible for their belongings, which is why renters’ insurance is often required. However, for those who offer furnished homes, you can have your belongings covered for an additional fee. It’s well worth it for peace of mind.