Real Estate Investing

Real Estate Investing

Published Date: 2025-01-20

Scott Robey and his family wanted to move to Colorado so they could help care for her ailing mother. However, after trying to sell their house for six months so they could move, the couple found out...

read more

Real Estate Investing

Real Estate Investing

Published Date: 2019-11-11

CHBO has been a part of the corporate housing business for many years, which means we can offer with certainty the most commonly asked questions from property owners to their CHBO Property...

read more

Real Estate Investing

Real Estate Investing

Published Date: 2019-04-10

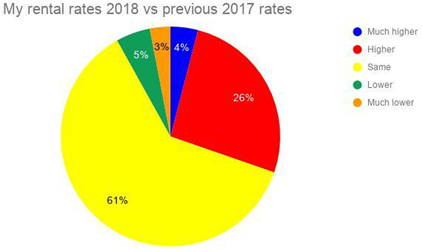

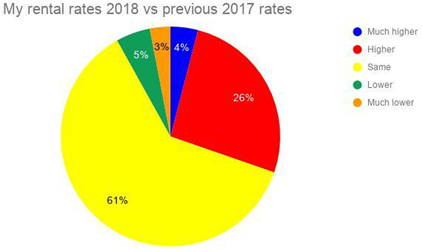

Variance: Changes in Rental

Rates

We asked respondents to evaluate their current rental rates compared to the previous year for the exact same rental property.

Annual...

read more

Real Estate Investing

Real Estate Investing

Published Date: 2019-04-08

Whether you need a Scottsdale executive rental for an extended work visit

to the region, for medical purposes, relocation

or even a lengthy holiday, this remarkable option in Scottsdale...

read more

Real Estate Investing

Real Estate Investing

Published Date: 2019-03-28

Exclusive Offer!

Do you want to be in the know on housing issues and linked to other providers asking relevant questions about your industry?

Join Corporate Housing & Furnished...

read more

Real Estate Investing

Real Estate Investing

Published Date: 2018-11-26

The term 'Cyber Monday' was created by marketing companies to encourage people to shop online and Cyber Monday is time when corporate tenants, and shoppers in general, are looking for good deals....

read more

Real Estate Investing

Real Estate Investing

Published Date: 2018-08-24

Have you, like millions of others, watched the whole tiny homes trend develop? People downsizing their possessions to such a degree that living in homes of 300 square feet or less is the foundation...

read more

Real Estate Investing

Real Estate Investing

Published Date: 2018-01-12

Those who own corporate housing properties and short term apartments know that there are a lot of moving pieces involved. It is never just a matter of keeping properties booked and clients happy....

read more

Real Estate Investing

Real Estate Investing

Published Date: 2016-03-29

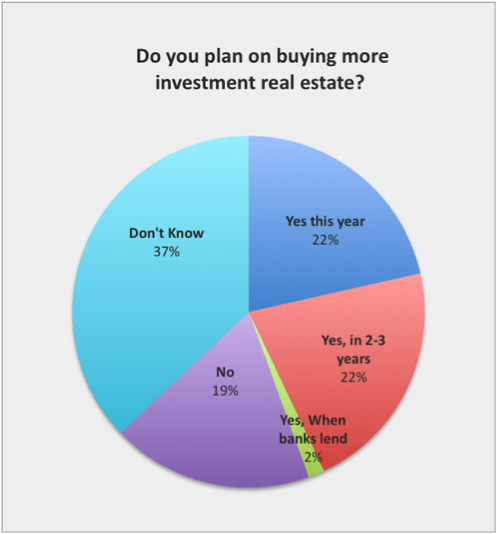

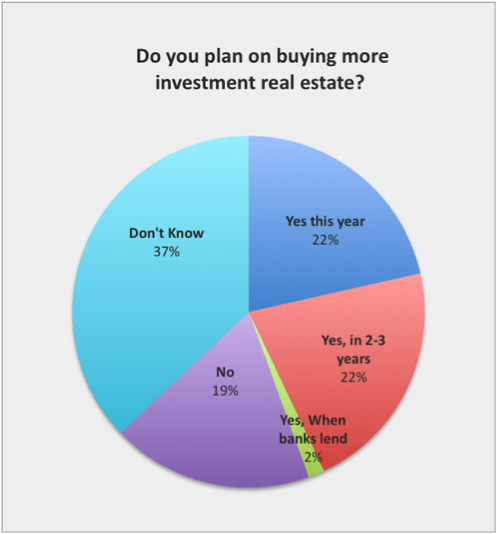

The answer is "Yes."

Question: "As a real estate broker does it make sense to learn more about corporate housing real estate investing."

Why: "Because the survey says people want to buy more!"

If...

read more

Real Estate Investing

Real Estate Investing